How to pay taxes on crypto

How do I report my cryptocurrency trading on my taxes?

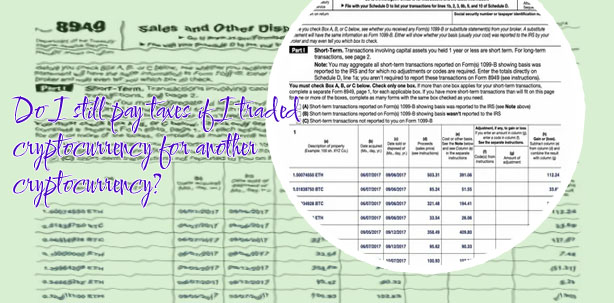

Cryptocurrencies, including non-fungible tokens (NFTs), continue to be treated as “property” for the purposes of tax in the United States. This was originally decided by the IRS in a notice published in 2014 and means that a majority of taxable actions involving digital assets will incur capital gains tax treatment, similar to how stocks are taxed. Cryptocurrencies received from select activities, however, are treated as income and therefore subject to income tax treatment. Do you pay taxes on crypto if you don t sell Emerging market and low-income economies have a significant untapped tax potential of 8 percent to 9 percent of GDP

Is converting crypto a taxable event

3. Understand how DeFi and ICOs are taxed

Even if you haven’t received a 1099 in recent years, you are still on the hook for taxes on virtual currency transactions. The IRS has stated that cryptocurrency is treated as property, which means if you sell or exchange your virtual currency for a profit within a year of buying or receiving it, the gains count as taxable income. If you’ve held for over a year, then your gains or losses are taxed as capital gains or losses. Method 2: Automating your crypto taxes Suppose you initially purchased 1 BTC for $10,000 and less than a year later decided to exchange it for ETH when the price of 1 BTC was $40,000. This would be considered a taxable event and you would need to report a capital gain of $30,000 ($40,000 - $10,000) on your tax return. Since you held the 1 BTC for less than one year it would be considered a short-term capital gain and you’d have to pay taxes at the applicable ordinary income tax rate.

Do you pay taxes on crypto if you don't sell

- Is cryptocom available in new york

- Ethereum crypto

- Buy btc with credit card

- Bitcoincom exchange

- Create cryptocurrency

- How do you buy cryptocurrency

- Buy baby dogecoin

- What the hell is bitcoin

- Btc price converter

- Lightcoin price usd

- Best sites to buy cryptocurrency

- Types of bitcoins

- Selling crypto

- Cryptos

- Cryptocom app review

- Safemoon crypto com

- How many btc are there

- Bitcoin's value today

- Buy crypto with credit card

- Crypto exchange

- Gas fees eth

- Is crypto com down

- Cryptocom headquarters

- Crypto pc

- Cryptocurrency apps

- Cryptocom cards

- Cryptocom sell to fiat wallet

- Dogecoin to a dollar

- Who created bitcoin

- Where to buy crypto

- Btc live price

- Learn cryptocurrency

- Cryptocom news

- Bitcoin starting price

- Cryptocurrency bitcoin price

- Crypto com not working

- Eth max price

- Cryptocurrency prices

- Where to buy new crypto coins

- Cryptocom card

- Cryptocoin com coin

- Bitcoin spot

- Is transferring crypto a taxable event

- How to withdraw money from cryptocom

- Crypto wallet app

- To invest all profits in crypto

- Bitcoin halving price prediction

- Bitcoin cryptocurrency

- Bitcoin price usd prediction

- Litecoin

- Litecoin price today

- When to sell crypto

- Dogecoin converter

- When to buy bitcoin